Cross-chain

financial protocol

financial protocol

Unlock financial potential with fixed-term liquidity: generate yield, borrow assets, and develop apps.

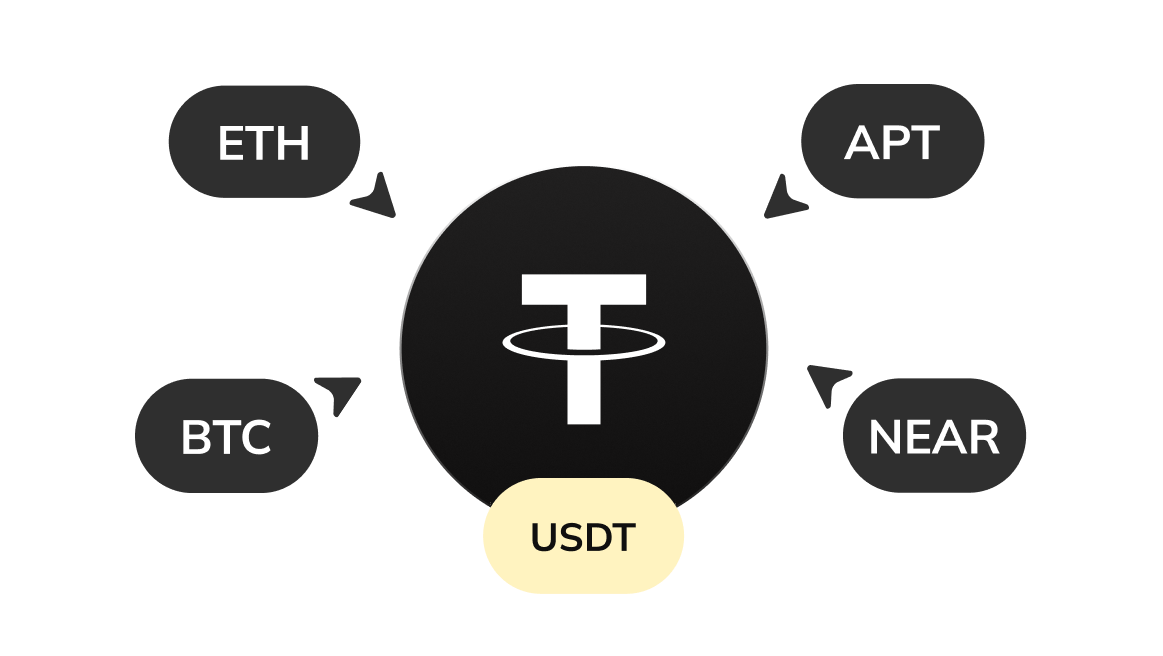

Cross-chain Lending

APY protocol offers fixed-term lending on over 20 chains through Wormhole.User

Can lend and borrow assets using their preferred blockchains

Cross-chain interoperability is achieved through Wormhole.

Cross-chain user account

Deposited

| SOL | 23.41 | |

| TRON | 1,255.01 |

Borrowed

| MATIC | 400.05 | |

| NEAR | 998.38 |

Powered by Solana chain

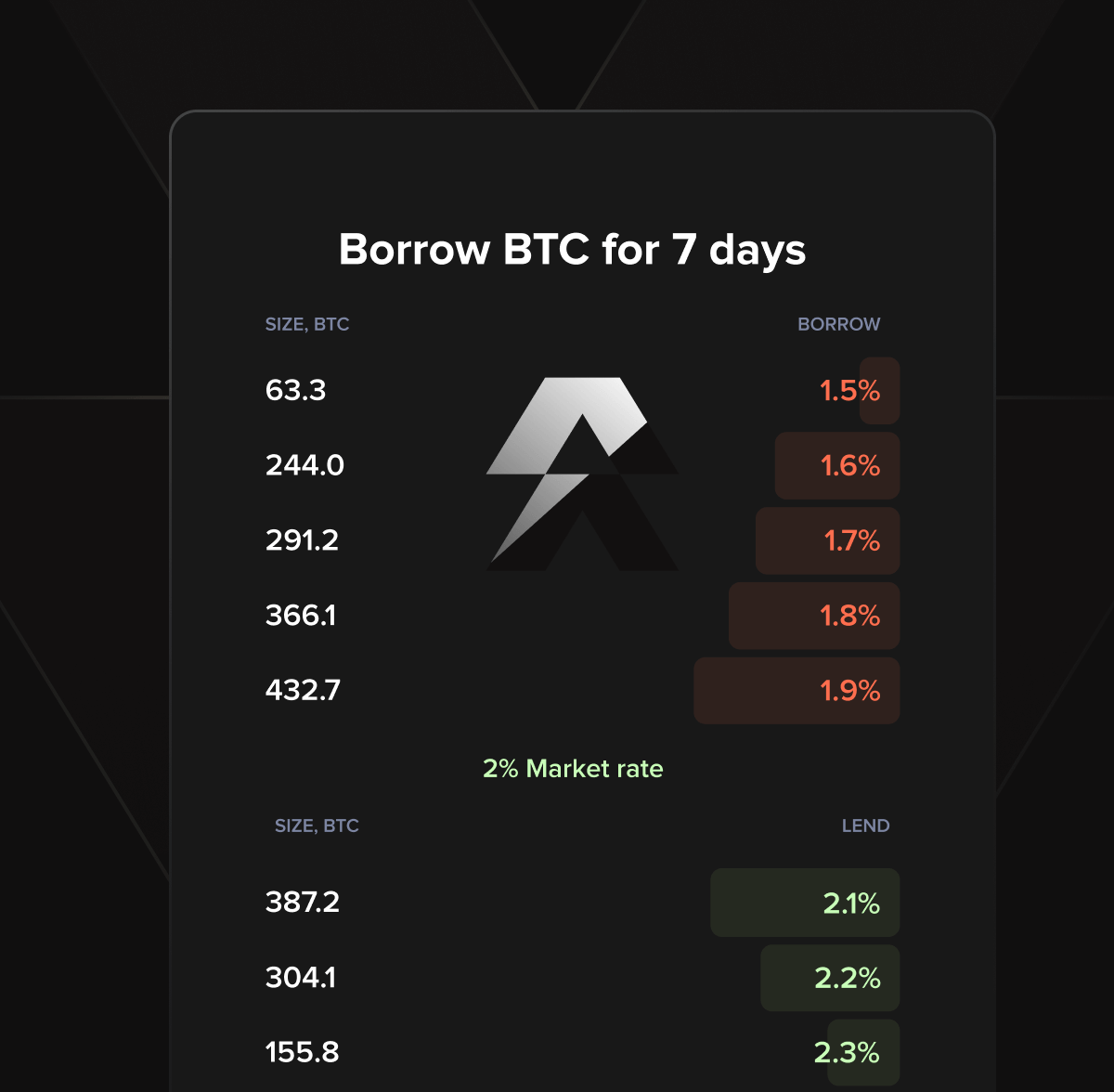

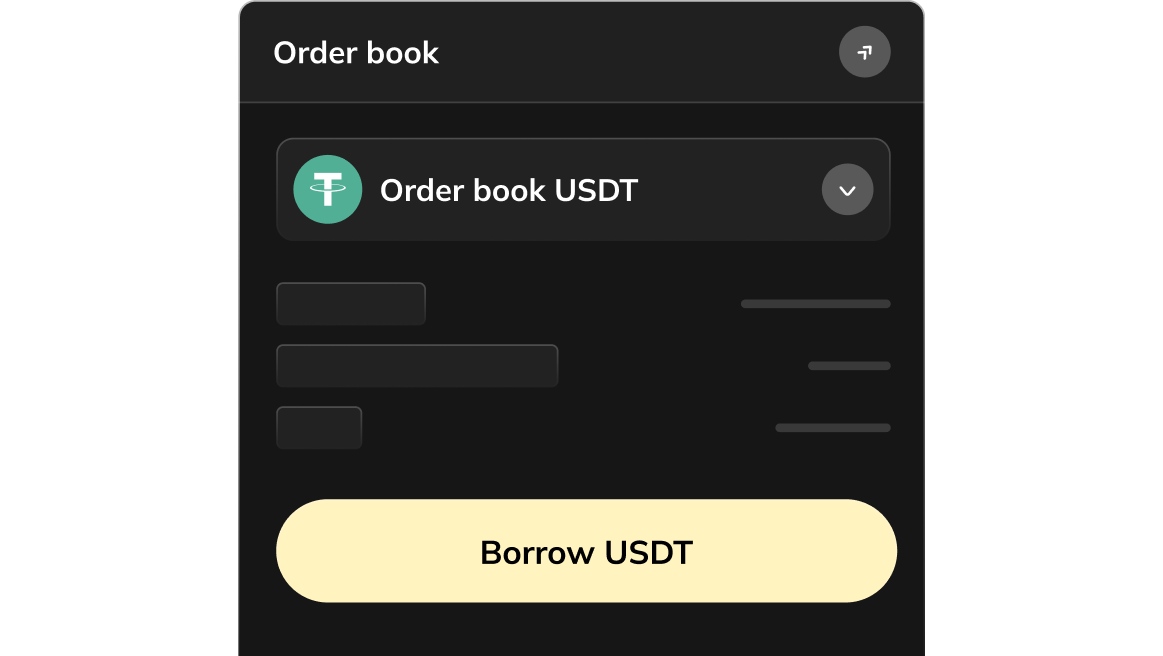

Orderbook to match requests

Efficiently matching lend & borroworders for assets and time periods

Based on Solana

Based on Solana  Powered by Openbook

Powered by Openbook  Coming soon Aptos

Coming soon Aptos

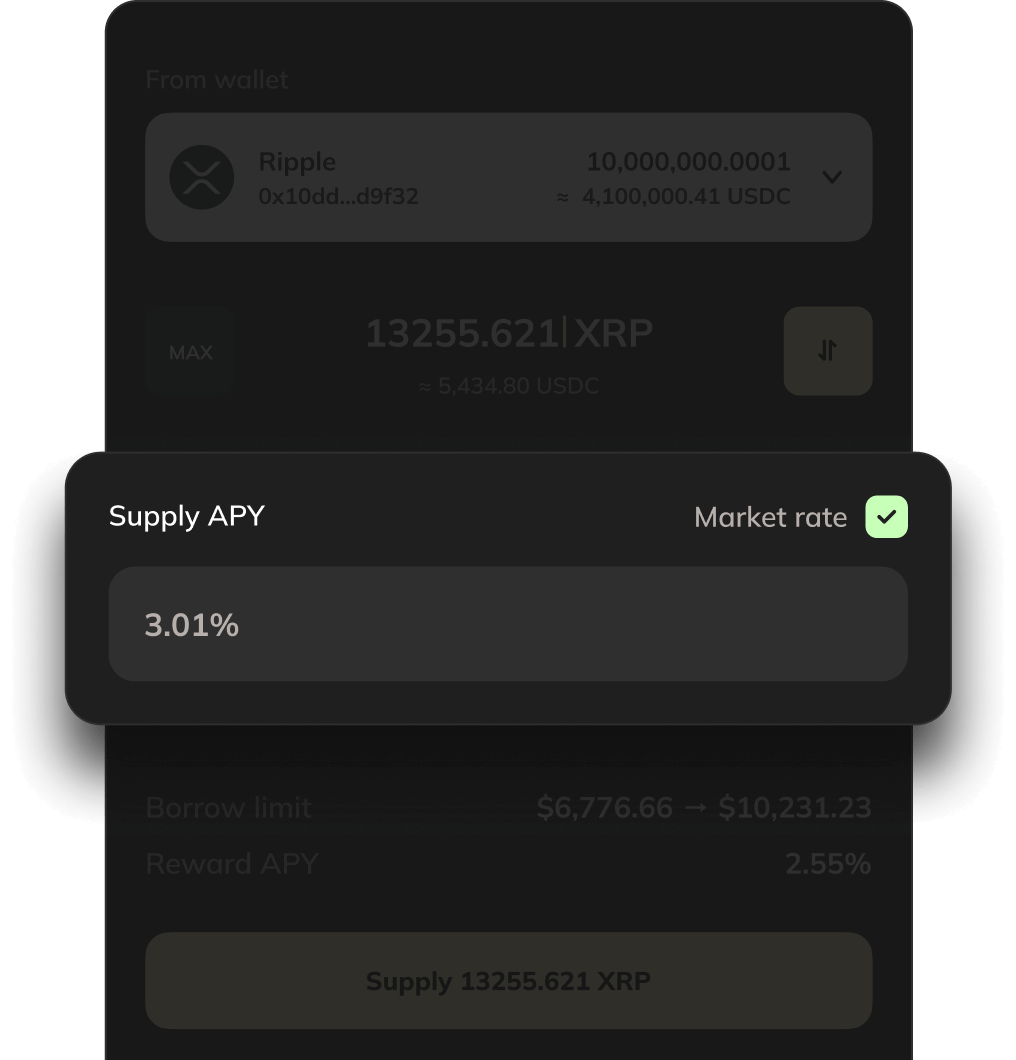

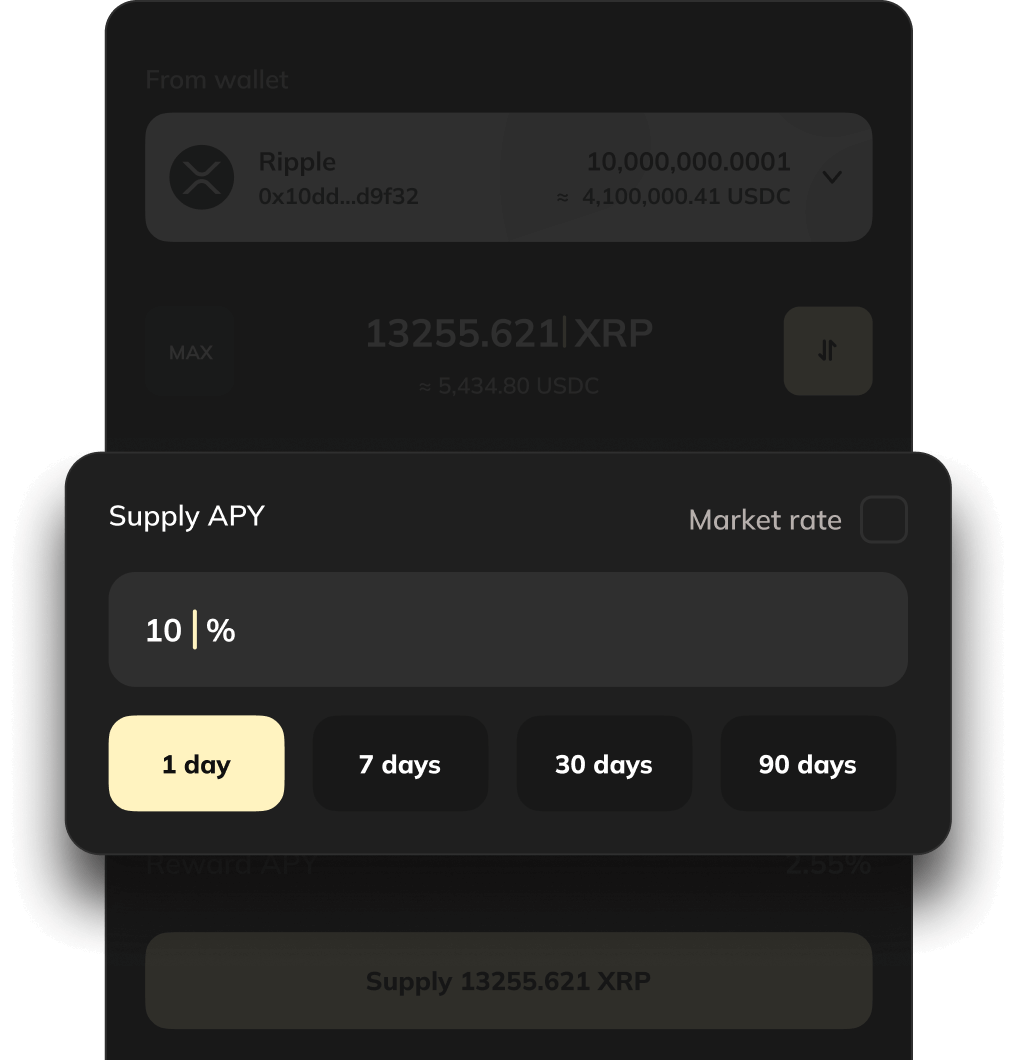

Flexible loan

term management

Follow the market terms or take control into your own hands.term management

Enhanced convenience for retail investors

-

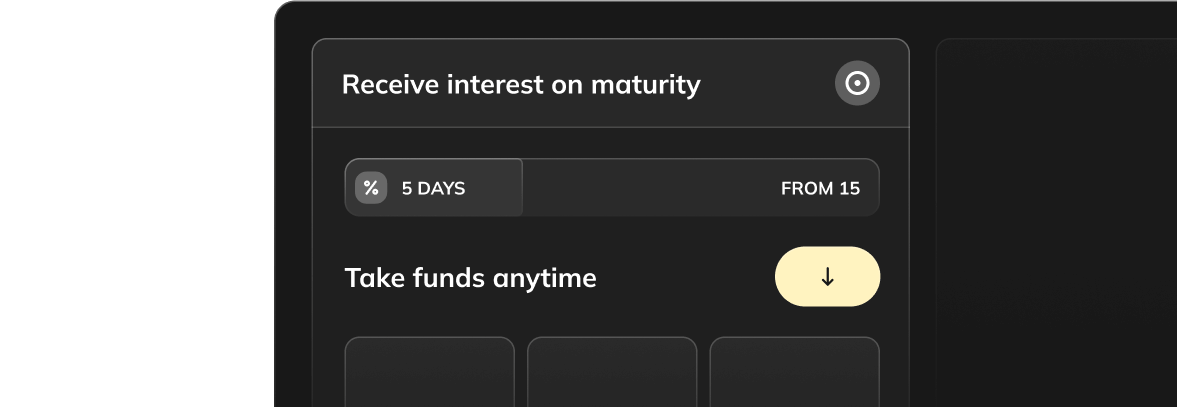

Withdrawal before maturityLiquidity providers can repurchase lent funds before maturity. You'll receive the funds back but earn no interest

-

Automated lend/borrow systemConfigure your lending and borrowing requests to auto-reroll after maturity

Cross-collateral loan

Cover debts with various assets in your portfolio, including those that are lent out-

Borrow one

type of asset

-

Pay back with

other assets

Risk management

A robust risk management system that ensures the return of funds to lenders Margin trading

Unlock higher leverage and open short/long positions

Choose an asset to borrow from the list of available APY assets

OR

Borrow the available stablecoin and purchase the target asset through the integrated DEX

Open margin positions with cross-collateral leverage

APY nodes maintain the protocol

Nodes are central to the protocol’s system.They ensure its efficient operation via:

- Keeping the OrderBook up-to-date

- Updating asset order prices from oracles feed

- Fulfilling reroll calls for automated orders

APY Token

DAO

- Add/Remove assets to the protocol

- Change risk parameters of assets

- Bounty programs

- Liquidity incentives program

- Protocol fees changes

Utility

- Reduce fees for trading on DEX

- Reduce fees for lend/borrow assets

- Staking

GET STARTED RIGHT NOW